In today’s fast-paced world, choosing the right bank that suits your financial needs can be a daunting task. With numerous options available, individuals often struggle to make informed decisions about their banking choices. However, Panorabanques, a leading bank comparison platform, has revolutionized the way people select their financial institutions. By providing a free and user-friendly service, Panorabanques enables customers to make a well-informed choice, tailored to their specific requirements. This article explores the benefits of using Panorabanques, how it works, and why comparing banks is crucial for achieving financial success.

Understanding Panorabanques

Panorabanques is an innovative bank comparison platform that simplifies the process of selecting the right bank by providing an unbiased and comprehensive comparison of various banking institutions. This user-friendly platform offers a personalized questionnaire, enabling users to input their preferences, needs, and expectations from a bank. The platform then matches these requirements with a vast database of 180 banks, including both traditional and online options, allowing customers to make the best decision possible.

The Benefits of Bank Comparison

Choosing the right bank is a critical financial decision that can significantly impact one’s everyday life. Panorabanques aims to make this process more straightforward and transparent for consumers. By comparing banks, individuals can take advantage of several benefits:

- Cost Reduction: One of the key advantages of using Panorabanques is the ability to compare bank charges. The platform provides detailed information about various bank fees, helping customers find cost-effective options and save money on essential services such as credit cards, bank transfers, and overdrafts.

- Personalized Recommendations: Panorabanques takes into account each individual’s specific needs, whether it’s having a dedicated advisor, access to branches, or seamless online and mobile banking services. By understanding these preferences, the platform offers personalized recommendations that align with customers’ requirements.

- Improved Financial Visibility: With a personalized comparison, users gain better visibility of their banking budget. Understanding the various costs and services associated with each bank empowers customers to make informed choices that optimize their financial well-being.

- Keeping Up with Banking Trends: Panorabanques also provides users with the latest news and updates from the banking world. This ensures that individuals stay informed about new products, services, and offerings, allowing them to remain ahead in the ever-evolving financial landscape.

Traditional vs. Online Banks

Panorabanques acknowledges that different customers have diverse preferences and needs when it comes to banking. Traditional banks, like Société Générale and BNP Paribas, offer the advantage of physical branches, providing face-to-face interactions and personalized services. On the other hand, online banks, such as Boursorama Banque and Fortuneo, offer lower bank charges and are ideal for customers seeking digital and cost-effective solutions.

How to Use Panorabanques

Using Panorabanques is a straightforward process:

- Fill Out the Questionnaire: Customers begin by filling out a personalized questionnaire, sharing their preferences and requirements.

- Compare and Choose: The platform then compares the data with its extensive database of banks and financial institutions, offering customers a list of options tailored to their needs.

- Make Informed Decisions: Armed with comprehensive information, customers can make an informed decision about their banking choice, ensuring their financial needs are met efficiently.

How Bank Comparison Works

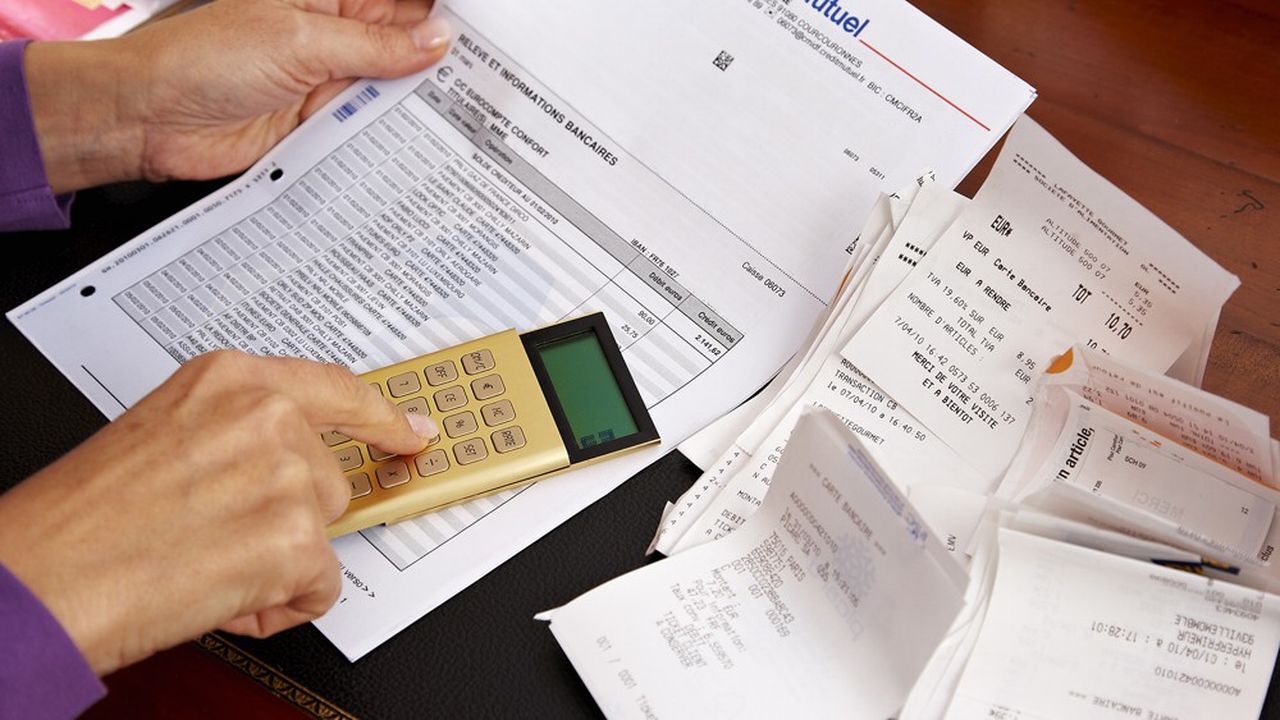

Every bank offers different services, features, and charges, making it challenging for individuals to find the one that best suits their needs and budget. Let’s delve into the importance of comparing banks, the criteria to consider, how to go about it, and the benefits of using bank comparison platforms.

The Importance of Comparing Banks

A significant number of people tend to stick with their current bank without considering the alternatives available. However, comparing banks is a crucial step in ensuring that your current bank aligns with your financial requirements. By comparing different banks, you gain several benefits:

- Cost Savings: Banks have varying rates and fees, and by comparing them, you can find cost-effective solutions that help you save money on services you use regularly, such as bank cards, overdrafts, and transfers.

- Tailored Services: Each individual’s financial needs are unique, and different banks cater to diverse requirements. By comparing banks, you can find the one that offers services best suited to your specific situation and needs.

- Welcome Offers: Some banks provide welcome offers, such as cash bonuses or discounts on bank cards for the first year. Comparing banks allows you to take advantage of these offers and reap additional benefits.

Criteria to Consider When Comparing Banks

When comparing banks, it’s essential to focus on the criteria that align with your financial habits and priorities. Here are some key factors to consider:

- Banking Products and Services: Evaluate whether you use all the services included in your current banking plan and if you genuinely need the privileges associated with an expensive bank card.

- Banking Packages: Assess the price and offerings of banking packages that include services you frequently use, such as bank cards, overdrafts, and transfers. Compare the costs of these packages with their individual services to find the most cost-effective solution.

- Relationship with the Bank: Consider the proximity of the bank’s branches, the quality of customer service, availability of advisors, and the functionality of remote account management, including mobile applications.

How to Compare Banks

Comparing banks can be a time-consuming task, especially when you need to gather information from numerous banks individually. To streamline the process and save time, the internet becomes an invaluable tool. Here’s how you can effectively compare banks:

- Utilize Online Comparison Platforms: Bank comparison platforms like Panorabanques offer a convenient and free service that allows you to compare your current bank with others using a personalized simulation. These platforms provide insights into potential savings and help you find the bank that best meets your needs.

- Request Tariff Brochures: You can also visit banks’ physical locations or websites to request tariff brochures, which contain detailed information about their services and fees. However, this method may be more time-consuming compared to using online comparison platforms.

Benefits of Using Bank Comparison Platforms

Bank comparison platforms simplify the process of finding the right bank by offering the following advantages:

- Time-Saving: Instead of individually researching multiple banks, these platforms streamline the comparison process and present you with relevant information in one place.

- Transparency: Comparison platforms promote transparency by harmonizing tariff brochures, making it easier for customers to compare services and fees across different banks.

- Personalized Recommendations: Using a bank comparison platform, you receive personalized recommendations based on your specific financial requirements, ensuring that your choices align with your needs.

Bank comparison plays a vital role in making informed financial decisions. By comparing banks, individuals can save money, access tailored services, and take advantage of welcome offers. Utilizing bank comparison platforms like Panorabanques further enhances this process by offering a transparent, time-saving, and personalized solution. Whether you are looking to reduce bank charges or seeking the best services to suit your lifestyle, using bank comparison platforms empowers you to make the best choice for your financial well-being.