Navigating the world of personal finance can feel overwhelming, but Borrowell is here to change that. Borrowell, a leading financial technology company, offers a suite of tools and resources designed to help Canadians take control of their finances. From free credit score monitoring to personalized financial product recommendations, Borrowell makes financial wellness accessible and easy. Dive into this playful and engaging guide to discover why Borrowell should be the go-to choice for anyone looking to achieve financial freedom.

A Quick Introduction to Borrowell

Borrowell was founded with a mission to make financial prosperity possible for everyone. By leveraging technology, Borrowell provides Canadians with the insights and tools needed to make informed financial decisions. Whether it’s understanding credit scores, finding the best financial products, or getting tips on improving financial health, Borrowell covers all bases.

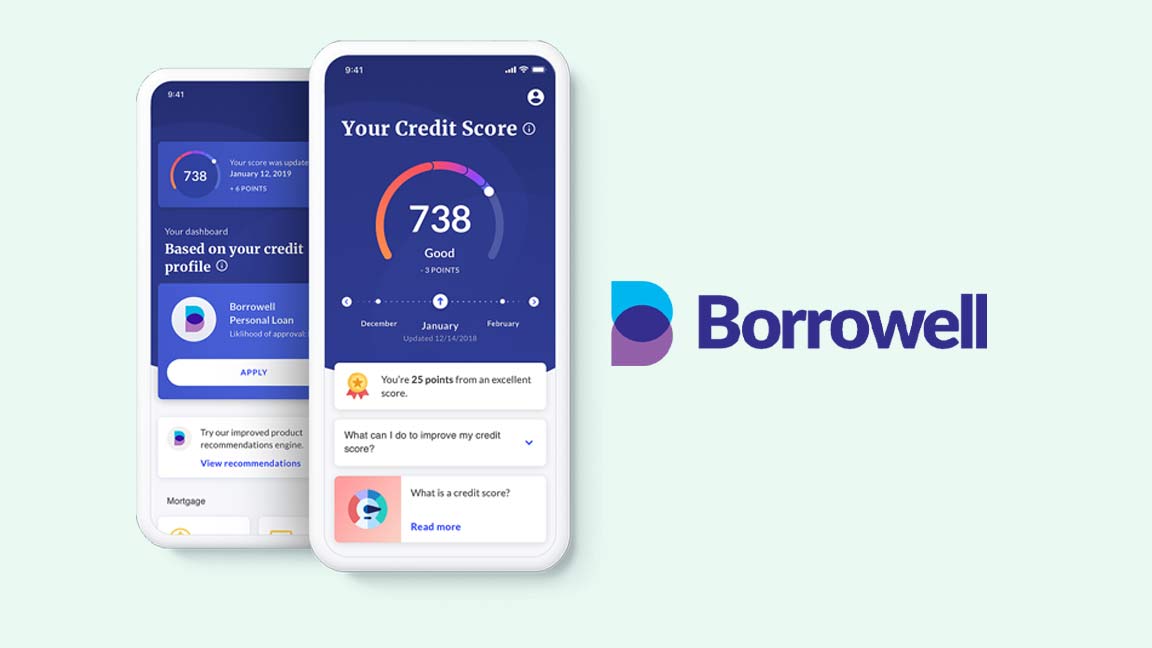

Free Credit Score Monitoring

Understanding credit scores is a crucial part of financial wellness, and Borrowell makes it easy with free credit score monitoring. Every week, users receive updates on their credit score, along with detailed reports that explain the factors influencing it. This service empowers users to keep an eye on their credit health, spot any errors, and take proactive steps to improve their score. With Borrowell, monitoring credit is simple, informative, and absolutely free.

Personalized Financial Insights

One size doesn’t fit all when it comes to finances, and Borrowell understands this well. The platform provides personalized financial insights tailored to individual financial situations. By analyzing credit data and financial behavior, Borrowell offers customized advice and product recommendations. This personalized approach ensures that every user receives the most relevant and effective financial guidance.

Find the Best Financial Products

Choosing the right financial products can be daunting, but Borrowell simplifies the process with its comprehensive marketplace. From credit cards and loans to mortgages and insurance, Borrowell curates a range of financial products from trusted partners. Users can compare options, read reviews, and find products that best meet their needs. This streamlined approach saves time and helps users make confident financial choices.

Easy Loan Applications

When it comes to borrowing money, Borrowell makes the process straightforward and hassle-free. The platform offers a seamless loan application process, allowing users to apply for personal loans with just a few clicks. Borrowell partners with reputable lenders to ensure that users have access to competitive rates and terms. This easy and transparent process makes borrowing money less stressful and more accessible.

Financial Wellness Tools

Borrowell goes beyond credit scores and loan applications by offering a suite of financial wellness tools. Budgeting tools, savings tips, and debt repayment strategies are just a few of the resources available to users. These tools are designed to help individuals manage their money better, build savings, and reduce debt. Borrowell’s holistic approach to financial wellness ensures that users have everything needed to achieve and maintain financial health.

Educational Resources

Financial literacy is key to making smart financial decisions, and Borrowell is committed to educating its users. The platform offers a wealth of educational resources, including articles, guides, and webinars on various financial topics. From understanding credit scores to mastering budgeting techniques, Borrowell’s resources are easy to understand and highly informative. This commitment to education empowers users to take control of their financial futures with confidence.

User-Friendly Platform

Borrowell’s platform is designed with the user in mind. The intuitive interface makes it easy to navigate, find information, and access services. Whether on a computer or a mobile device, users can manage their finances on the go with ease. The sleek and user-friendly design enhances the overall experience, making financial management less intimidating and more accessible.

Excellent Customer Support

Borrowell prides itself on providing excellent customer support. Users can access help through various channels, including email and live chat. The support team is knowledgeable, friendly, and ready to assist with any questions or concerns. This dedication to customer satisfaction ensures that users always have the support needed to navigate their financial journeys.

Trust and Security

When dealing with financial information, trust and security are paramount. Borrowell employs robust security measures to protect user data and ensure privacy. The platform uses encryption and secure servers to safeguard sensitive information, giving users peace of mind. Borrowell’s commitment to security and transparency has earned it the trust of millions of Canadians.

Join the Borrowell Community

Being part of Borrowell means joining a community of individuals committed to improving their financial health. Borrowell’s social media platforms and community forums provide spaces for users to share experiences, exchange tips, and support each other. This sense of community adds an extra layer of value, making the journey to financial wellness more engaging and enjoyable.

Conclusion

Borrowell is more than just a financial tool; it’s a partner in the journey to financial freedom. With its free credit score monitoring, personalized insights, comprehensive product marketplace, and educational resources, Borrowell equips users with the tools and knowledge needed to make smart financial decisions. The user-friendly platform, excellent customer support, and commitment to security make Borrowell a trusted choice for Canadians looking to take control of their finances.

Discover the power of Borrowell and unlock the door to financial wellness today.